According to the latest debt numbers, the United States national debt is now over $31 trillion – and remember, that number doesn’t even consider unfunded liabilities such as Medicare, Medicaid, and Social Security! When unfunded liabilities are included in our national debt balance sheet, as private companies are legally required to do, but the federal government somehow fails to do, you can tack on another $162 trillion in unfunded liabilities debt.

It’s hard to see how we get out of this disaster unscathed.

In reality, the federal government can never pay these unfunded obligations; they are essentially bankrupt and have entered the land of make-believe accounting.

The reality is that for over a decade, the U.S. Government Accountability Office has warned, “The Federal Government is on an Unstable Fiscal Path,” adding, “Growing debt is not just a number—it represents a threat to our economy and our ability to meet national needs and priorities.” During that same time, national security leaders have sounded the alarm trying to tell the public that the national debt is a “top national security threat.”

John Adams once wanted, “There are two ways to conquer and enslave a country. One is by the sword. The other is by debt.” We have now doubt been enslaved by both!

Inflation, Stupidity, and a Brainwashed populous have created the Perfect Financial Storm

According to a recent survey of American adults, 61% of Americans — roughly 157 million adults — say they are living paycheck to paycheck. While inflation has undoubtedly added to the number, so has Stupidity. In fact, More than a third of high-earning American workers say they are now struggling to cover monthly expenses and get out of debt.

Thirty-six percent of U.S. employees with salaries of $100,000 or more say they are now living paycheck to paycheck — that is twice as many who said so when surveyed in 2019, according to a survey conducted by Willis Towers Watson, a consulting firm.

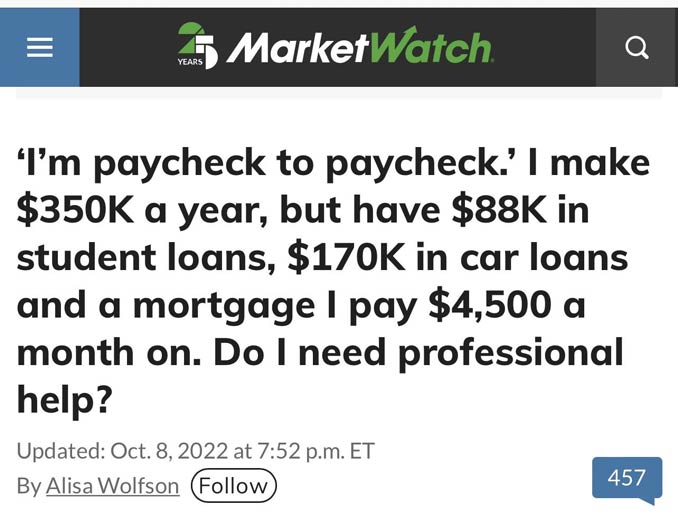

The utter stupidity of people is hard not to take into account, just look at the latest headline from Market Watch.

We live in a society that is no longer interested in saving, preparing for the future, or being mindful of surviving disasters. The COVID generation is convinced that the government has a magic shot that will save them no matter what crisis may hit. In fact, many so-called financial experts are also living the samedelusion.

Take the Market Watch article, here is a website dedicated to the market and helping people make “smart money moves”. Yet, not once did the experts tell the millennial jackass who makes more than enough money to live comfortably, even in today’s market, that maybe he should have paid off his student loans and his debt before spending 170K on car loans and signing up for a 4,500 a month mortgage. With a $350,000 a year income, the moron could have paid for a small house and two cars in cash – instead, he is now struggling to pay his bills because reality T.V. told him he should keep up with the Kardashians.

Economic Collapse Watch: Americans Resorting To Microloans to Buy Gas and Groceries!

As we reported earlier in the year, things are getting so bad that lenders are now starting programs to give out microloans to people who need help buying groceries and gas!

E.J. Antoni, a research fellow for regional economics in the Center for Data Analysis at The Heritage Foundation, told the Daily Caller News, “The average worker has lost the equivalent of almost $3,400 in annual income since Biden took office.”

As we reported in an earlier article, throughout the world we are starting to see uprisings and people rioting over food.

While the mainstream media refuses to cover the chaos, food freedom movements, shortage riots, and protests against destructive climate policies are becoming a global movement. For example, the freedom farmer protests in the Netherlands have now spread to Germany, Poland, and Italy, and protests and even uprisings against governments have spread to other areas of the world.

Total chaos in Haiti. The revolt against rising FuelPrices and the high cost of living turns into food riots with warehouses looted by the population. The country has been paralyzed for 3 days. All the banks in the country are closed like many embassies. pic.twitter.com/XqGYSZdwts

— The International Magazine (@TheIntlMagz) September 16, 2022

WATCH: Riots after bank in China’s Zhengzhou city froze deposits and barred people from withdrawing money pic.twitter.com/pYa4zDpJSR

— Insider Paper (@TheInsiderPaper) July 11, 2022

Preparing for an economic collapse

Twenty years ago, most people would have said you were crazy for thinking our system could collapse. Unfortunately, even today, most of our country is either unaware or has forgotten how close we came to the complete collapse of the financial system during the banking crisis of 2008.

If you’re not prepared, you need to start taking steps to protect yourself and your family from future troubles.

Keep an eye on the markets, and keep an eye on the banks.

Before depositing any money in a bank, you need to research the financial soundness of that bank. Since the so-called end of the financial crisis, when the government spent over 700 billion dollars to “fix the system,” over 511 banks have failed.

With so many banks still going under, you really have to wonder how long the FDIC can continue to pay out on these insured deposits. With banking industry assets sitting at around $22.7 trillion, there is little reason to believe the FDIC can cover these insured deposits during a full-scale collapse.

While many believe the FDIC protects their money, the simple truth is, there’s not enough money to protect everyone. If the system collapses, your FDIC-insured account is anything but certain.

Realize your dollars may become worthless.

Over the last year, our money has become worth less and less by the month. From gas prices that have more than doubled in the last couple of years to soaring food prices and sky-high interest rates, our dollar is already becoming less valuable.

It would be best if you seriously looked at the possibility of an all-out collapse of the system. If this were to happen, your dollars would quickly become worthless.

You must start to take a balanced approach to being financially prepared for the future. While investing in your financial future is important, the same can be said for investing in your ability to survive future disasters. If you haven’t started preparing for economic troubles, now is the time to seriously consider stocking up to survive future financial problems.

Be Prepared to Defend Yourself

- Situational Awareness: How to Protect Yourself by Developing your Situational Awareness

- 7 Rules of Self Defense

- Self Defense: Defending yourself from multiple attackers

- Improvised Weapons: Self-defense in the Real World

- The Ultimate Situational Survival Guide: Self-Reliance Strategies for a Dangerous World

Investing in long-term consumable goods.

This means stocking up on items you will need and use in the future or stocking items you can barter with in case the system fails. By stocking up on food, water, survival gear & supplies, and bartering goods, you will have a nice stockpile of supplies that will help you through almost any disaster.

Another upside to investing in consumable goods is these goods are completely secure from financial market volatility and will continue to hold their value after the collapse. In fact, as we’ve seen over the last year, most consumables will probably skyrocket in value in a post-collapse world.

Be Prepared to Feed Yourself when the Collapse Hits!

- Best Emergency Food: The Top Survival Food Supplies

- Survival Food – 56 Long-Term Survival Foods and Supplies at the Grocery Store

- Prepper 101: Your Survival Guide to Getting Started

Grocery Options that ship right to your Home:

Learn to Be Self-sufficient NOW!

To truly be prepared, you need to learn how to be 100% self-sufficient.

- 30+ Self-Reliant Resources: Preparedness Skills that Everyone Should Know

- Urban Resources: Finding Food & Water During a Long-term Disaster

- Survival Fishing: Top Tips for Finding Fish during a Long-term Survival Situation

- Off Grid Living: A Real-world Guide to Going Off the Grid

- Homeschool: Taking your Child’s Education Off The Grid!

We are there. Our wonderful country is broke. We will have to default on our obligations. Our federal government will not do anything to resolve this issue.

Prepare for the coming s__t storm.

There is no question in my mind, that the debt was in design by the ones in charge. We all need to start our own version of a victory garden!!